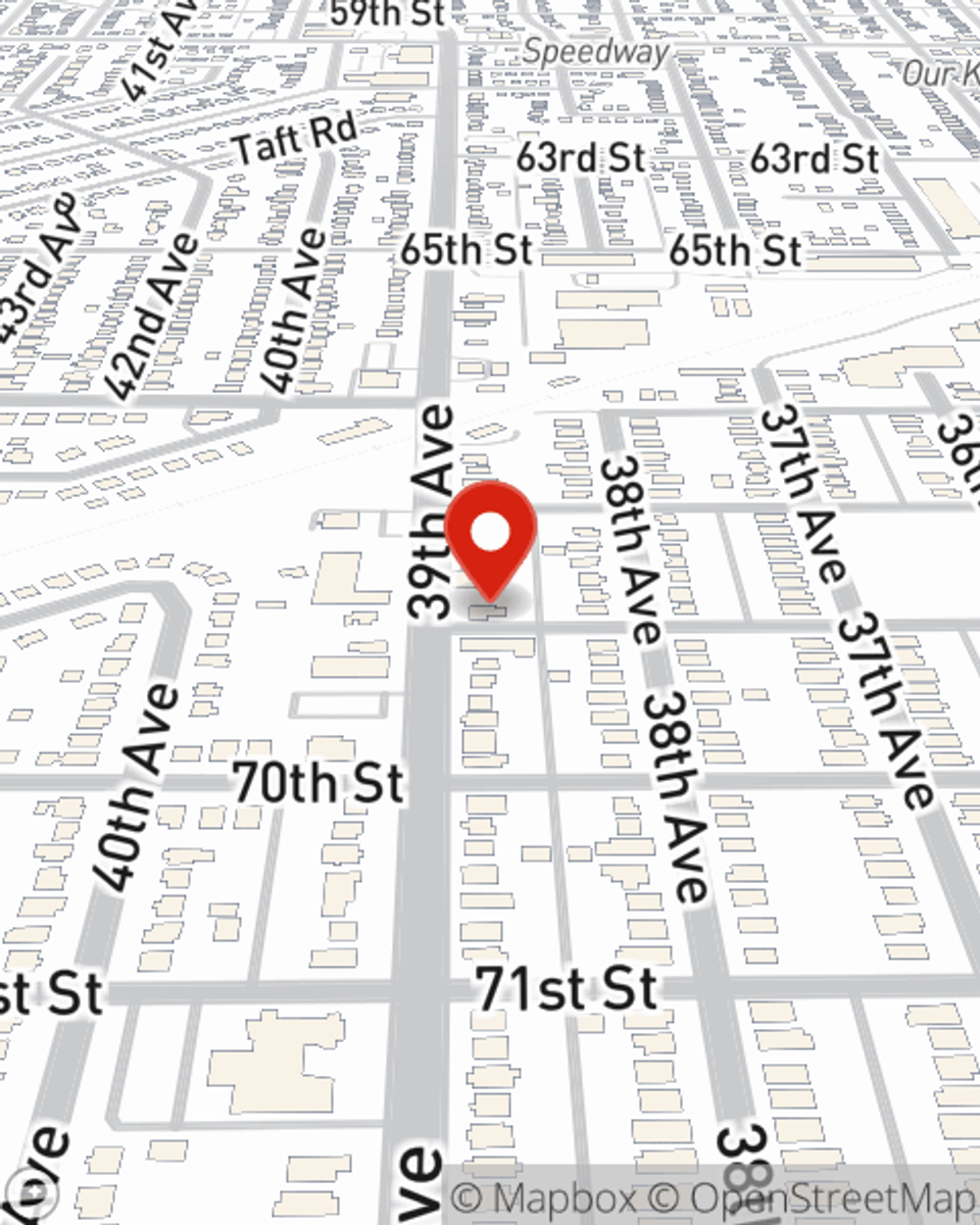

Business Insurance in and around Kenosha

Kenosha! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Vince Iaquinta help you learn about excellent business insurance.

Kenosha! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

If you're looking for a business policy that can help cover business liability, computers, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Vince Iaquinta's team today with any questions you may have.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Vince Iaquinta

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.